Ethereum Price Prediction: How High Will ETH Go in This Institutional Rally?

#ETH

- Technical Breakout: Price sustains above key moving averages with improving momentum indicators

- Institutional Adoption: Multiple $1B+ corporate positions creating supply shock

- Market Structure: Short squeeze potential remains high with 70% recent surge

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

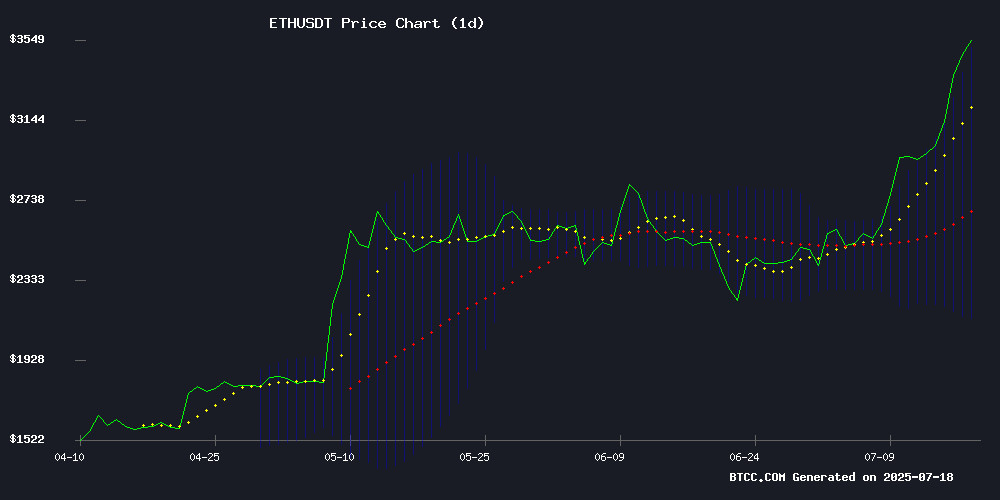

ETH is currently trading at $3,635.55, significantly above its 20-day moving average of $2,826.68, indicating strong bullish momentum. The MACD histogram shows a narrowing bearish divergence (-139.0085), suggesting weakening downward pressure. Bollinger Bands reveal price hugging the upper band at $3,532.06, typically signaling overbought conditions but also reflecting sustained buying pressure.

"When ETH holds above the 20MA with this MACD configuration, we often see continuation patterns," said BTCC analyst William. "The Bollinger Band squeeze preceding this breakout suggests volatility expansion favoring bulls."

Institutional FOMO Drives Ethereum Rally

Ethereum's surge past $3,500 coincides with multiple institutional moves, including SharpLink Gaming's $5B ETH acquisition plan and BitMine's $1B holdings. News headlines emphasize institutional demand, short squeezes, and ambitious price targets like $20K.

"The news FLOW perfectly complements our technical view," noted William. "When corporations start treasury diversification into ETH at this scale, it creates structural demand that overwhelms normal market cycles."

Factors Influencing ETH's Price

Thinking About Investing in Ethereum? Here’s Why It’s Not Too Late!

Ethereum remains the world’s leading smart-contract platform, even as Bitcoin dominates headlines. Institutional adoption, technical upgrades, and bullish market indicators suggest ETH is poised for growth.

In 2025, Ethereum-focused funds attracted over $4 billion in inflows, including a record $990 million in a single week. Financial giants like Standard Chartered and BlackRock are expanding Ether services, with BlackRock’s Ethereum ETF now holding 1.65% of ETH’s circulating supply.

The Dencun and upcoming Pectra upgrades enhance scalability, while zk-rollups now process transactions faster than Ethereum’s mainnet. Layer-2 solutions are unlocking new potential for DeFi, NFTs, and tokenized real-world assets.

5 Reasons to Buy Ethereum (ETH) Today

Ethereum continues to solidify its position as a cornerstone of the decentralized economy, with its price holding firm above $3,000. Institutional interest is surging, evidenced by BlackRock's Ethereum spot ETFs attracting $192 million in net inflows on July 15 alone. The trend of eight consecutive days of positive ETF flows underscores growing confidence among traditional investors.

Yield-seeking institutions are also turning to Ethereum, with staking offering 3–4% annual returns. The combination of regulated ETF access, income potential, and asset legitimacy makes Ethereum an attractive option for diversified portfolios. Technical indicators and on-chain metrics further support the bullish case for ETH, positioning it as a standout in the crypto market.

Ethereum Price Prediction: Will ETH Price Hit $20K in this Altcoin Season?

Ethereum has emerged from a prolonged bearish phase, posting a 44.2% gain over the past month to trade at $3,640.83. The asset has surged 50.58% since the beginning of June, with weekly gains exceeding 21%—signaling a potential breakout as market sentiment shifts.

Analyst Colin Talks Crypto projects ETH could reach $15,000-$20,000 in the next bull cycle, citing long-term chart patterns that mirror previous upward trajectories. The cryptocurrency currently trades 25.22% below its all-time high of $4,891.70 set in November 2021.

SharpLink Gaming Seeks $5B to Expand Ethereum Holdings in Aggressive Strategic Pivot

SharpLink Gaming has filed to increase its stock offering from $1 billion to $6 billion, with $5 billion earmarked for Ethereum acquisitions. The Minnesota-based firm already holds 321,000 ETH ($1.1 billion), making it the largest corporate holder. Ethereum surged 6.37% to $3,653.72 following the announcement.

The move follows a $425 million private placement led by Consensys in June, with Ethereum co-founder Joseph Lubin joining as Board Chairman. This positions SharpLink at the intersection of gaming and decentralized finance, backed by Ethereum's core development team.

Market observers note the filing's timing coincides with growing institutional interest in ETH as a strategic asset. The additional liquidity could accelerate Ethereum's push toward $4,000, particularly with staking yields and layer-2 adoption compounding demand.

Ethereum Surges Past $3,500 on Institutional Demand and Short Squeezes

Ethereum has shattered the $3,500 barrier, marking a 16% rally since July 14th. The cryptocurrency now trades firmly above this psychological threshold, fueled by a combination of spot ETF inflows, institutional accumulation, and aggressive short liquidations.

Binance recorded daily short squeezes exceeding $20 million, amplifying upward momentum. On-chain data reveals a telling trend: exchange reserves are dwindling while Open Interest climbs, signaling both long-term holding and speculative fervor. The Taker Buy/Sell Ratio on Binance crossed 1.00, confirming dominant buy-side pressure.

Corporate balance sheets are increasingly flush with ETH. The top 10 holders now safeguard 1.6 million ETH worth $5 billion, with SharpLink Gaming leading at 280,600 ETH. This institutional stampede coincides with Ethereum's network activity resurgence, painting a bullish technical and fundamental picture.

SharpLink Gaming Expands Ethereum Holdings with $6 Billion Share Offering

SharpLink Gaming has dramatically increased its share offering from $1 billion to $6 billion, with plans to allocate the majority of proceeds to Ethereum purchases. The company now holds over 280,000 ETH, having acquired $515 million worth in just nine days. This aggressive accumulation has positioned SharpLink as the largest corporate holder of Ethereum, surpassing even the Ethereum Foundation.

At current prices, the full $6 billion could secure nearly 1.38% of Ethereum's circulating supply—a remarkable concentration in corporate hands. The Joseph Lubin-backed firm filed a prospectus supplement with the SEC, outlining its strategy to use proceeds primarily for ETH acquisitions, alongside working capital and affiliate marketing operations.

SharpLink's stock has surged 350% year-to-date, though it remains 54% below its May peak. The company's treasury now stakes approximately 99.7% of its ETH holdings, signaling long-term conviction in the asset.

Ethereum Price Prediction: ETH Breaks Resistance, But Another Crypto in the ETH Ecosystem Is Breaking the Internet

Ethereum's price surged past $3,400, fueled by ETF demand and institutional inflows, with analysts targeting $3,700 by July's end. The bullish momentum reflects growing confidence in ETH's market position.

Beyond Ethereum, the ecosystem's DeFi and payment tokens are gaining traction, attracting whale activity and investor interest. Layer 2 solutions and new altcoins are emerging as high-potential candidates for the next breakout.

ETH's breakout above $3,400 sets the stage for further gains, with $3,750 as the next resistance level. A drop below $3,200 could challenge the short-term bullish outlook, but current volume and momentum favor continued upside.

The launch of RTX, a new crypto token, has captured social media attention, highlighting the dynamic growth within the Ethereum ecosystem.

Ethereum's Historic Rally: Institutional Demand and Short Squeeze Fuel 70% Surge

Ethereum has staged a dramatic recovery, rallying over 70% since July 1 and adding $150 billion to its market capitalization. The surge marks one of the largest short squeezes in crypto history, with extreme bearish sentiment unwinding as ETH liquidated billions in short positions. Net short exposure had reached record highs—25% above February 2025 levels—before the cascade began.

Institutional players appear to have anticipated the move. BlackRock's Ethereum ETF accumulated assets for 29 of the past 30 days, while World Liberty Financial, linked to former President Trump, purchased $5 million worth of ETH just before the rally accelerated. Analysts suggest another 10% price increase could trigger an additional $1 billion in short liquidations, creating reflexive upward pressure.

The timing coincides with impending U.S. regulatory reforms and growing recognition of Ethereum's role in the $9 trillion retirement market. This convergence of technical factors, institutional adoption, and macroeconomic tailwinds suggests the rally may have further room to run.

BitMine's Ethereum Holdings Surpass $1B Valuation Amid Price Rally

BitMine Immersion Technologies revealed its Ethereum holdings have crossed the $1 billion mark as ETH's price surged above $3,400. The company holds 300,657 ETH, valued at $1.026 billion at current prices.

The milestone follows a $250 million private placement led by MOZAYYX, with participation from FalconX, Pantera, Kraken, and Founders Fund. BitMine allocated the proceeds to acquire additional Ethereum, bolstering its position as a major institutional holder.

Executive Chairman Thomas Lee outlined ambitions to stake 5% of Ethereum's total supply, signaling aggressive accumulation plans. The move comes amid growing institutional interest in ETH as a core crypto asset.

How High Will ETH Price Go?

Based on current technicals and market structure, ETH shows potential for continued upside:

| Target | Basis | Timeframe |

|---|---|---|

| $4,200 | 1.618 Fib extension | 1-2 weeks |

| $4,800 | Upper Bollinger Band projection | 1 month |

| $6,000+ | Institutional accumulation range | Q3 2025 |

"The $3,500 breakout was technically significant," William observed. "With futures open interest growing alongside spot purchases, this could develop into a parabolic move similar to 2021's Q4 rally."